The Central Bureau of Direct Taxes (CDBT) today in a surprise circular said that those having income below Rs.5,00,000.00 will also have to file returns for the Financial year 2012-13 for the year ending 31.03.2013. The article appeared in Times of India, Mumbai edition today which you can read here. This is a very surprise move because for the earlier two AYs 2011-12 and AY 2012-13, the Income Tax department had exempted those who were earning less then Rs.5.00 lakhs from filing any returns. However with just 8 days remaining for the deadline, Income Tax department is expected to extend the deadline in lieu of rush on the above order.

I have already give a tutorial for e-filing Income Tax returns offline which you can refer to here.Today I am giving a tutorial for step by step guide for e-Filing the Income Tax Returns for A.Y. 2013-14 online. This method is easier then the offline method and can be used if you are salaried employee. Do remember to keep your PAN Card Number, Form 16 and Bank A/C details ready for proceeding with it.

1. Go to the Income Tax departments e-filing site here. Register yourself as per below pic. Remember to give a proper password.

In the registration Page give your status as individual as below

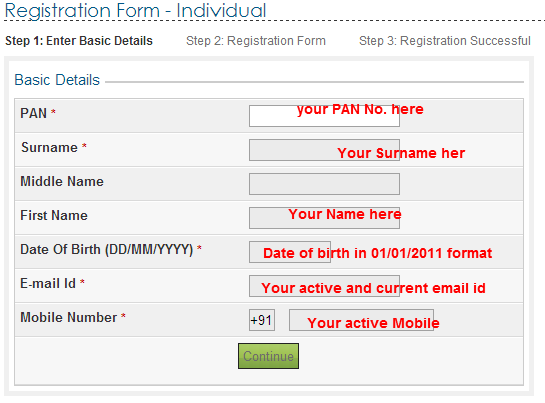

Press Continue and this will bring you to another window. This is a important window. You should fill in your correct PAN (Permanent Account Number), your name, Mobile phone No. email id as illustrated below :

Follow the steps in the Registration form page two and three and after successful registration, you will get a email in your inbox. You have to open this email and activate the user name (PAN number)

Once activated you head back here. Login using the PAN number date of birth in 01/01/2011 format and the password you had given at the time of registration. Once you have successfully entered the above details you will be led to this page. In this page select the Quick e-File ITR as given below to proceed further

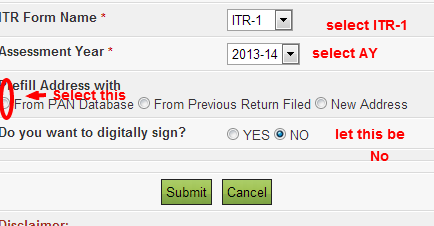

In the next window you will be asked to fill in the ITR No. Select ITR 1 from the drop down box and AY 2013-14 from the next drop down menu. Select From PAN Database (This is important)

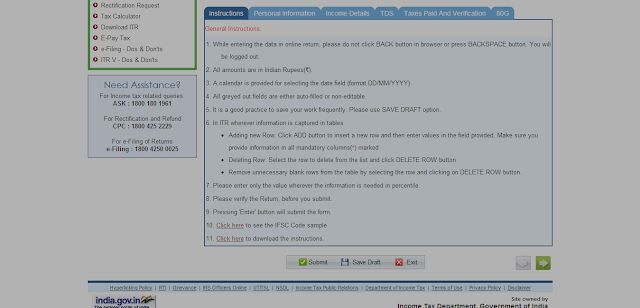

From here you will be led to this page.

You can see that it has six fields at the top and submit, save draft and exit at the bottom.

Keep on pressing SAVE DRAFT every 5 minutes as if you don't you will have to login again and complete the process again(the website also reminds you that). In the next field i.e. PERSONAL INFORMATION fill in the personal details carefully. In the filing Status field use the illustration below

Press Save Draft and proceed to INCOME DETAILS field. Enter your income details in this Page and the deductions under Chapter VI A as given in your Form 16.

In the Taxes Paid and Verification, the taxes if already deducted will appear automatically. Refunds due if any will also show up in this field. In the Bank details field on this page fill in the proper bank details including the IFSC code. You can check the IFSC code from your Chequebook, Pass book or here(this is a lengthy process) The IFSC code is a 11 letter code which always starts with the bank name for example State Bank of India code always starts with SBIN.

Once you have filled the details correctly press the submit button at the bottom of your page. The website will ask you to confirm whether the details are correct. Press yes and there it is done!

The page will show you ITR V which can be downloaded. You will also receive a copy of the ITR V in the email id you have given on the Personal Information page(not in your registration id).

Your ITR-V/ Acknowledgment is protected by a password for your security. Please enter your PAN (in small letters) and Date of Birth or Incorporation (in ddmmyyyy format), in combination, to view your ITR-V/Acknowledgment. If your pan is AAAPA0000A and the date of birth is 10-Jan-2008, then the password will be aaapa0000a10012008.

Remember to send it by Speed Post/Ordinary Post only Courier is not allowed.

Address :

Income Tax Department - Centralized Processing Centre,Post Bag No - 1,Electronic City Post Office,Bangalore - 560100,Karnataka - India.

If you have any problems with the above kindly comment on it and I will try to solve your problem. If you have successfully filed your e-Return with my tutorial, kindly post in your comments also.

This is a far easier method but requires little patience and diligence. Remember by paying your taxes and filing your returns, you not only take part in nation building but you also save your valuable time and resources.

:)

:)

:-)

:-)

:))

:))

=))

=))

:(

:(

:-(

:-(

:((

:((

:d

:d

:-d

:-d

@-)

@-)

:p

:p

:o

:o

:>)

:>)

(o)

(o)

[-(

[-(

:-?

:-?

(p)

(p)

:-s

:-s

(m)

(m)

8-)

8-)

:-t

:-t

:-b

:-b

b-(

b-(

:-#

:-#

=p~

=p~

:-$

:-$

(b)

(b)

(f)

(f)

x-)

x-)

(k)

(k)

(h)

(h)

(c)

(c)

cheer

cheer

Very very useful. Thanks 4 saving my money.

ReplyDeleteThanks for sharing Vijay..I also have go for I-Returns now..

ReplyDeleteThanks a lot Prabhu sahab for sharing this worthful tutorial! Technology News and Updates (h)

ReplyDelete:d

ReplyDeleteWithout filling income details I submitted. As I got filled all the TDS Details from PAN Card, I submitted the form. What Can I do now? How to resubmit now? Please guide me to proceed.

ReplyDeleteReegan that is why I have written at the beginning of the post to be patient and diligent while filing the return. You can now proceed the steps again and in the main form press revised Return button but this time do it very carefully

DeleteHope that helps (c)

Thank you Sir for your valuable guidance and current updates

ReplyDeleteThank you all your appreciation encourages me to write more (h)

DeleteSir I entered my income details and now on verification tab it showing tax payable = 3023. Plz tell me is this the tax that i've to pay. I save my details as draft and not clicked on submit button. Plz tell me now what should i do...

ReplyDeleteSir,first kindly verify whether you employer has filled in the correct details while file the quarterly return. If the tax payable amount is indeed correct, Pay the tax via Challan 280 at any nationalized bank counter and then fill in the return

DeleteYou can get a printout of Challan 280 here >http://law.incometaxindia.gov.in/dittaxmann/incometaxrules/pdf/challanitns-280.pdf

hope this helps (c)

I selected a wrong assessment year..is there a way to fill it again?

ReplyDeleteWell Abhijeet if you wrong assessment has been accepted start the process all over again and select revised application from Image 1 above ie. FROM PREVIOUS RETURN FILED. That should do it and hopefully your ITR will be done :)

DeleteThanks for your valuable information and for guidance (o)

ReplyDeleteThanks Sathya your words encourage me to give out more useful articles. Do sign in to the newsletter from comboupdates through the SUBSCRIBE NOW widget on the right side and do visit comboupdates again :)

DeleteIs there any extension for filing sir

ReplyDeleteNo Sathya as of now no update on extension but I think it will be extended due to the fact that itax site was down yesterday due to bandwidth overload.

DeleteI will make a post or add it here if anything comes up

x-)

ReplyDeleteHi.. i filled my 2013 -14 IT returns but my first name is displayed in last name... I couldnt change it.. Field is disabled.. So i enter my first name in first name field.. So in ITR-4 form, my first name is only displayed twice like ARCHANA ARCHANA... Do i need to fill it again.. Please suggest...

ReplyDeleteArchana, if your name in the PAN details is Archana Archana nothing can be done about it but if it is not then do refill the form and check. Hurry today is the last date for filing :)

DeleteThanks a lot for the detailed guidance.. :)

ReplyDeleteIs there any chance to file income tax for AY 2012-2013

ReplyDeleteHi All,

ReplyDeleteOne of friend not filed the income tax for 2012-2013 AY

Can he file now, if yes let us know the process to file income tax for AY 2012-2013 now.

Thanks in advance

Regards,

Nagesh

Hi Nagesh yes your friend can fill the IT returns for any AY. Just choose the Assessment Year you want to fill in from the dropdown box in Figure 5 above. As long as your friend has already paid his taxes there shouldnt be any problem

DeleteHope this helps

Vijay

ReplyDeleteAgain the time has come when you have to assess your total income and file the income tax return.

The last date for filing the income tax return is 31.7.2014. Please file it before the due date so as to avoid penalty and interest.

Please contact us below to file your income tax return:

Need Help?

(Company India Advisors)

Call : 09818092002

Email : companyindiaadvisors@gmail.com

http://indiaincometaxreturn.blogspot.in/

hi,

ReplyDeleteMy Tax refund for the year 2013 - 14 was rejected due to wrong Bank details updated while filing return.

Please suggest with further details

Swapnali there is a rectification button or you can fill a revised return for the year 2013-14 giving correct details.

Deletetoday 17/10/2015 and i fill return a.y.2013-14 on 14/10/2015, but some mistake i wish to revised it, so this is REVISED ??

ReplyDeletePLS. TELL ME FURDHER DETAILS !

today 17/10/2015 and i fill return a.y.2013-14 on 14/10/2015, but some mistake i wish to revised it, so this is REVISED ??

ReplyDeletePLS. TELL ME FURDHER DETAILS !

Reply

hello ! pls. reply

ReplyDeleteHello Bhavesh,

ReplyDeleteSorry for the delay :( Regarding your query, you have to fill a revised return to make any changes to the already filed/updated ITR

Regards